A recent report from one of Ireland's most influential business The Irish Business and Employers Confederation (IBEC)has called for immediate reform of public sector pensions. Pension Reforms Urgent

All public sector pension plans, either in Ireland or Canada, work the same way. They are based on final salary. They are not true pensions but a guaranteed payment of income in retirement. A public sector employee is guaranteed an income in retirement based on 70% of their final working salary or wage. This income replacement is guaranteed for life and guaranteed to increase every year.

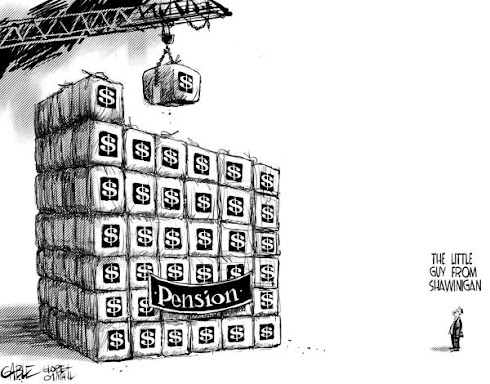

The cost to all taxpayers of these plans is unsustainable.

In Ireland the cost of the public sector wage and pension package is over 50% of all government expenses. In Canada it is higher than 50%. For every tax dollar paid over half of it goes to pay for wages and pensions of public sector workers. The pay is 35% higher in the public sector compared to the private sector and the public sector employee retires with a retirement income equivalent to a million dollar retirement fund.

The same basics apply to public sector pensions in Ireland and Canada. In fact, most public sector pensions around the world work the same way. What is needed is a complete overhaul of the system. The IBEC recommends a series of reforms.

* New entrants into the public sector should be entitled to the same type of pensions as most of the private sector that is defined benefit plans. Not guaranteed final salary plans. The taxpayer in the private sector only collects what will be in his savings plan at retirement but the public sector has their continuing income plan guaranteed by the taxpayer.

* Ending the pay parity link, where public servants are guaranteed pensions based on the ongoing salary of the job they held. Most public sector employees earn their highest levels of income in the past few years. This is what the guaranteed retirement income is based on. Check the sidebar in this blog for the Sunshine List. This is the list of all public sector workers in Ontario earning more than $100,000 per year. All of the employees on this list will earn 70% of this income in retirement.

* The government should set a contribution rate cap after which employees would fund liabilities on an equal basis. In Canada the true cost to fund these plans is about 30% of income. Most public sector employees contribute only 8% or 9%, you the taxpayer contribute the rest. As a private sector worker the most you can contribute into your retirement plan is 18%. Most Canadians contribute only about 5% into and RRSP.

* All public servants should contribute to the costs of funding benefits. The employee benefits paid to the public sector are far an above what is paid in the private sector. Taxpayers fund most of this.

These reforms are included in the article in the link above. The rest of this news article shows the determination with which the public sector will defend their gold-plated pensions and benefits.

Bill Tufts

No comments:

Post a Comment