St John has been dealing with some issues in its city employee pension plan.

Taxpayers are concerned that despite increasing tax rates the quality of services provided from the city are falling. One of the areas of city spending that requires constant increases is the city pension. As a result of some investigations by a city councilperson some pension irregularities were identified. The pensions irregularities were a very small part of the problem with St John pensions.

Problem with pensions

The real problem with the pension is the very nature of public sector pensions. As cited in Global Economic Trend Analysis there are several reasons these pension are not sustainable. Basically in a nutshell, they are too generous in what they offer to public sector employees.

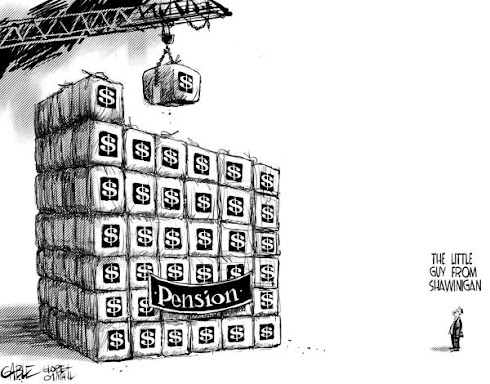

Many governments and businesses around the world are fighting to control the cost of pensions. We have seen the effect of huge legacy costs and their impact on business. Many large businesses that offer these types of pensions are staggering under the weight of their pension obligations.

The pensions in the private sector pale against public sector pensions. Recently the mayor of the city of New York called for pension reform. Michael Bloomberg in his comments on government pension reform stated that: "The Big Three automakers offer some of the best pension plans in the private sector, yet even they cannot match the generosity of New York state government (all public pensions are the same from Alberta to Zimbabwe). And Detroit's expensive pension plans are part of the reason why the automakers are teetering on bankruptcy and pleading for a bailout in Washington."

Two types of pensions

One of the issues that makes pensions difficult to understand is the ways in which income is received from pensions.

Most Canadians save over their working career into a plan and what ever is in the plan at retirement becomes their retirement income. They draw down on the savings over the course of their retirement years. A public sector pension works on a completely different concept. It guarantees a certain level of income in retirement. These are two quite different types of pensions.

Definition - Pension

The Oxford dictionary gives two definitions of pensions. It describes the differences in the two plans well.

1) a regular payment made by a government to people above a specified age... or to such a person's surviving dependents - Public Sector pensions

2) a regular payment from a fund to which the recipient has contributed - private sector pensions - Private Sector pensions

As a result of the different concepts pension apartheid is created. The public sector pension is designed to provide pensions based on 70% of income at retirement. A private sector pensions will payout based on what is in the fund at retirement, usually substantially less. But the taxpayer funds them both.

Most taxpayers fund more into public sector employee plans than they fund into their own. Fair Taxes Now estimates that the city contributes over 14.5% of salary into city worker's pension plans. In the St John plan employees add another 8% to the city contribution. This 23.5% is still short of the true 30% that is needed.

The limit in the private sector is 18% and most Canadians put less than 5% into their RRSP plans. These huge gaps between the public and private sector pensions create the pension apartheid.

The CD Howe report A Pension in Every Pot shows the impact of the two different ways of calculating "pensions".

Two Pension Families, Two Results

* A typical private sector worker family retires with a fund valued at $ 255,000

* A typical public sector worker family retires with a fund valued in excess of $ 1,200,000

Unfairness of the system

It is unfair to ask the taxpayer to fund into a public sector gold-plated pension plan when their's will be considerably less than gold-plated.

The CFIB produced a report called the Pension Predicament and the conclusion of the report is that "Canada’s pension predicament is one of fairness between the public sector and the private sector...There is no valid reason why Canadian taxpayers are on the hook for public sector pension plans when in fact half of the Canadians working in the private sector will not even benefit from any private pension plan upon retirement. The unfairness has gone on long enough."

Other problems in St John

Part of the allegations against the pension plan is St John is that the pension plan was used to deal with long term disability cases within the city. If this happened it would be highly irregular and should be investigated or audited.

Part of the problem with public pensions is that the people who are entrusted with making the decisions about them usually have a vested interest because they will be paid a pension themselves. It is my opinion that if the taxpayers is paying over 70% of the bill for the pension they should have equal representation on the board of trustees of any pension plan.

Without proper checks and balances in place governments are free to negotiate with public sector unions without any accountability to the people they represent. For example, the provincial government recently negotiated that taxpayers fund an additional $131 million into provincial public sector pension plans. This was done without any consultation with taxpayer groups or general public consultation. The government justified this because of poor market performance last year. Was this decision made by members of the provincial pension plan? How much did they fund into your retirement plan?

Recommendations for public pension plans

1) Regular forensic audits - these should be conducted in addition to the regular every three year actuarial report which shows the funding in the plan. The audit should check such things as compensation paid to plan advisors, conflict of interest issues of trustee advisors, use of pension funds against unapproved uses

2) Trustee committees should be representative of the groups funding them. If they are totally funded by employees, then very well have plan member trustees but if the taxpayer is funding them then the taxpayer should be entitled to representation

3) Many jurisdictions around the world disclose the value of pensions being received by plan members. These are set up similar to the public disclosure for salaries for public servants.

Bill Tufts

In the name of Allah, Most Gracious, Most Merciful.

ReplyDelete1 Say: He is Allah, the One;

2 Allah, the Eternal, Absolute;

3 He begetteth not, nor is He begotten;

4 And there is none like unto Him.

112 - La fe pura (Al ejlas)

¡En el nombre de Alá, el Compasivo, el Misericordioso!

1 Di: «¡Él es Alá, Uno,

2 Dios, el Eterno.

3 No ha engendrado, ni ha sido engendrado.

4 No tiene par».

112 - AL-IKHLAAS

Dengan menyebut nama Allah Yang Maha Pemurah lagi Maha Penyayang.

1 Katakanlah: "Dia-lah Allah, Yang Maha Esa,

2 Allah adalah Tuhan yang bergantung kepada-Nya segala sesuatu.

3 Dia tiada beranak dan tiada pula diperanakkan,

112 - Zuiverheid van Geloof (Al-Ichlaas)

In naam van Allah, de Barmhartige, de Genadevolle.

1 Zeg: "Allah is de Enige.

2 Allah is zichzelf-genoeg, Eeuwig.

3 Hij verwekte niet, noch werd Hij verwekt.

4 En niemand is Hem in enig opzicht gelijk."

112 - Reinheit des Vertra�ns

Im Namen Allahs, des Gnädigen, des Barmherzigen.

1 Sprich: «Er ist Allah, der Einzige;

2 Allah, der Unabhängige und von allen Angeflehte.

3 Er zeugt nicht und ward nicht gezeugt;

4 Und keiner ist Ihm gleich.»