Today I was at the Farmer's Market in Hamilton for my usual weekly shopping. Outside the Federal Building I came a cross a large protest by the local USW union protesting for protection for pensions.

They have a right to be concerned about their pensions and the security of these pensions. I am not sure who they were protesting to but hopefully it gave them a sense of confidence that their pension would be dealt with fairly. They have worked long and hard for these pensions and trusted the companies they work for to save for their retirement. In hind-sight it was foolish to trust their unions and employers but that is what happened.

The people in the federal building where they were protesting are not very sympathetic as they themselves have fully guaranteed gold-plated pensions guaranteed by the taxpayers.

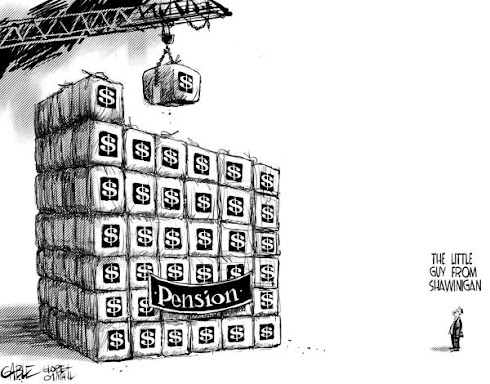

Accumulated Public Sector Pensions

As I have mentioned before the problem with the pension system is the cost of those gold-plated pensions that are given to the public sector. In Canada it is estimated that Canadian taxpayers have funded into these public sector plans which cover 20% of the workforce, in excess of $800 Billion, yes billion. Still the taxpayer will have to fund hundreds of billions more to fulfill the guarantees made on these pensions.

At the same time the private sector in Canada as accumulated almost $300 billion of pensions. We have funded more into the public sector than we have funded into our own pensions. And only 20% of all workers are in the public sector.

The public sector pension is not truly a pension but a guaranteed retirement income for life. It is based on a 70% of final working income, paid for life, guaranteed to go up each and every year and guaranteed to continue to spouses.

Value of these pensions

Let's look at the value of these guaranteed stream of income. A teacher currently in Ontario retires with over $90,000 of income. The retirement income (pension) value for this teacher is in excess of $60,000.

As a pensioner it has been estimated that the tax burden is 15% lower than a working Canadian. A working Canadian pays for CPP and EI as well as other related payroll taxes. For example, a self employed individual funds almost 10% of salary into CPP. The value of this 15% savings is $9,000 to the teacher's pension.

The OECD has estimated that a pensioner generally has a 30% lower cost of living. Part of the calculation is based on the fact that in Canada 80% of pensioners have no mortgage on their home. Most public sector workers are in the top 20% of income in Canada so probably most have paid off their mortgages. Also there are lower costs associated with not working such as transportation, clothing, telephones and lunches. This 30% adds another $18,000 to the retirement income.

We start with the $60,000 in guaranteed retirement income add another $9,000 for lower taxes and add another $18,000 for lower cost of living and we are now at $86,000. This is the equivalent of a $86,000 working income for the retired teacher.

The average working Canadian earns a little over $38,000 each year.

Time for Reform

These guaranteed retirement incomes need to be reformed.

In this example we have a retired government worker living on a taxpayer funded standard of living at $86,000 per year. Many families have two guaranteed retirement incomes.

Considering most of these retirement incomes are triggered around age 55, many are free to work other jobs. Most of these jobs are in other government departments or the same ones. This is where their connections are and where they feel comfortable working. Worse yet are those double dippers brought to my attention from J. Meyer - Teaching the Double Dip

Saturday, March 21, 2009

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment