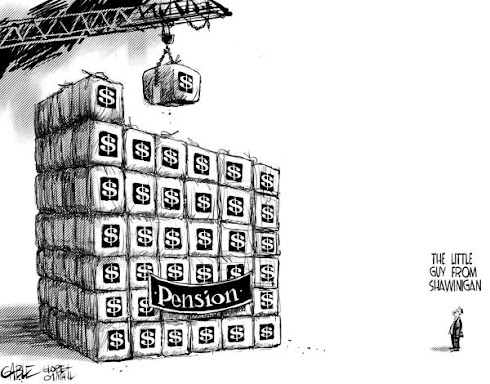

Activity has started up on the pension front as the fall begins. The summer was a little slower as everyone took a well needed break from what had happened in the economy over the past year.

Last week on a personal level there were some successes in the pension crusade and some disappointments.

A colleague and mentor of mine, Paul Holmes congratulated me on a article in the professional association magazine Forum. I was surprised as I was not aware of the article.

Forum is the official publication of Advocis, the Association for Life Insurance Financial Advisors. The Editor's article was a called The Haves and Have-Nots. It spoke about the pension dilemma.

There are already rumblings about the fairness of the system that rewards a certain class of workers with defined benefit pension schemes linked directly to salaries. One person leading the crusade to address the gap between the retirement haves and have-nots is Bill Tufts, a Hamilton-based pension specialist with WB Benefit Solutions.It was nice to be recognized in the industry I have worked for the past 15 years. However, the part about supplemental pensions was not quite accurate. I don't know how we as a society can afford them with the high tax rates we have as a country. The association had come from the Globe and Mail article with Roy McGregor, where I mentioned them as one option available.

On his blog he calls public sector pensions "the biggest economic issue in 2009". Tufts is calling for increased transparency of public sector pension plans and pushing the notion of a supplemental pension plan for private workers.

It is too bad there is not a link to the whole article on line but the magazine is a professional association publication. You can access the site of Advocis and check out their recommendation for pensions in Canada. It is Encouraging Small and Medium Sized Firms To Participate in Pension Plans

One disappointment of the week was the reporting on the University of Calgary President's pension. U of C to pay Weingarten $4.75M pension

Unfortunately the reporter for GlobalTV in Calgary who wrote the script for a TV newsclip had a very limit background on financial matters. She could not believe that the $4.75 Million paid to the President was based on 70% of his salary. We did not know his salary but I have a rule of thumb for estimating the cash value of pensions. An annual final salary pension has an equivalent cash value worth 16 times the annual pension.

In the case of the President I had estimated that the pension was worth $300,000 per year. We did not know right away but found out later that his current salary is $441,000. A pension at 70% of this would be $308,000 per year. Gross this up 16 times and you need a pension cash value of $4.9 million. Pretty close to the original amount quoted.

The reporters challenge was that over 30 years a $300,000 pension would pay out more than $9,000,000. This is correct however, the pension still is estimated to earn 5% per year and the payout is calculated for Cost of Living about 2.5%. Try running the calculation on a spreadsheet for 30 years. You will see there is still almost $400,000 left but don't forget about the surviving spouse.

The disappointment was the reporter had not covered pensions before. She found it difficult to grasp the concepts involved. Therefore she resorted to interviewing the official spokesperson at the University and other with vested interests. They too were collecting taxpayer funded pensions. Note the one comment about the $50,000 annual pension. Gross this up by 16 times and it is worth $800,000.

The Global TV Newsclip can be seen here at 39 minutes.

Oh well... win some lose some... It was a good experience fo me trying to clarify this muddy issue.

This only reinforces the purpose of this blog. That is to inform the public, public policy influencers and the media about how these pensions really work.