The 1970's were the beginning of large scale funding into pension plans. For example, most of the $100Billion accumulated into Ontario's Teachers Pension was saved over the past 30 years. The CPP Canada Pension Fund has accumulated over $100 Billion in a very short time.

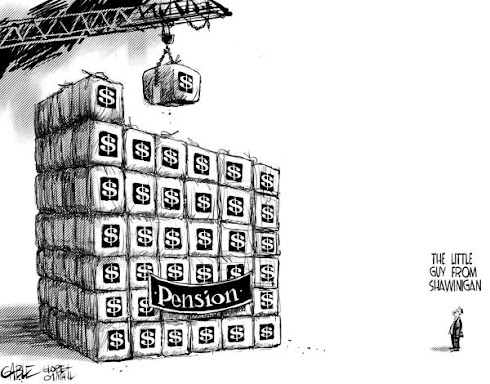

Socialism is occurring in most developed economies around the world. It is occurring through pension funds.

Socialism refers to various theories of economic organization advocating state, worker or public ownership and administration of the means of production and allocation of resources... Contrary to popular belief, socialism is not a political system; it is an economic system distinct from capitalismWikipedia

Long Term Implications

What will be the long term implications for capital markets and hence the means of production of the world being controlled by pension funds?

Some estimates place the total market value of the TSX at around $1.2 trillion. In Canada pension plans own a very substantial portion of those assets. The Economist

The major Canadian pension plans are owned and controlled by public sector unions. The Ontario Teachers for example, owns the a major portion of commercial property in Canada. As well they love monopoly and infrastructure industries where profits are in the range of 20% to 25% every year.

Political Implications

What will be the long term political implications?

The influence of pension funds around the world is going to have major implications on political policies. What is the impact of public sector unions controlling through pension funds most of a country's wealth?

Public sector unions are have very strong political views and the investments that they control will have major political influence. The public sector unions(CUPE) has very strong vies and opinions on several major social and political issues.For exampe the web site of CUPE speaks out on many issues:

Trade - Foreign policy

Mandatory retirement

World Bank

NAFTA

Social services

Racism

Poverty

Highways - Toll roads

These are all important issues. However, I am not sure that the public sector union view is always the best solutions for many of the problems facing our country.

Political Impotence

For some time I have had the view that the politicians in this country have less impact on government workings and policies than the union bureaucracy. Now the bureaucracy now has the economic levers as well.

Despite the rhetoric the public sector unions do not always represent the best interest of the Canadian public. In a fight over what is best for society and what is best for the unions, the unions always side with members.

We have the situation that the long term government policies are set and impacted by government union members.

When it comes to making decisions will the unions do what is best for Canada or what is best for their pension funds? One example of this is the 407 Highway in Toronto. It is one of the most expensive highways in the world.

Is the pricing on this road based on what is best for the economic movement of goods around the metro area or what is in the profit interests of the pension plans that own the 407?

Beaten at Our Own Game

As we see the rise in Pension Socialism in the western world we are at risk of being overtaken by the BRIC (Brazil, Russia, India, China) countries. With the rise of the middle class in these countries the rise of capital will be staggering.

The Wall Street Journal today reports that Pension Funds in Asia Passed Europe's in 2008. What will happen as more and more the workers in these countries begin to accumulated capital into pension funds? China starts pension plan trial for 800 mln farmers

These pensions funds will want to start to invest in the popular investments of pensions funds:

Infastructure

Real Estate

CommoditiesThere will be many very interesting developments to come in the years ahead.

No comments:

Post a Comment