Alberta and the rest of the Western Premiers are Pushing for new Pension Plan

It is a great idea but how will it be funded?

The Fraser Institute figures that already we work more than 5 months before we start to save money for ourselves. How can we save more money for the Supplementary Plan?

Fraser Tax Freedom Day Video

As a self-employed individual I pay into the CPP (Canada Pension Plan)at the rate of 9.9% of my income, up to the YMPE. It provides me with a replacement of 25% of the YMPE.

Where can I come up with more money to pump into a government run pension plan? The only way is to reduce the taxes I pay every year. This would leave me more money to fund into my personal plan. However, this will never happen because I have several public sector pension plans I need to fund.

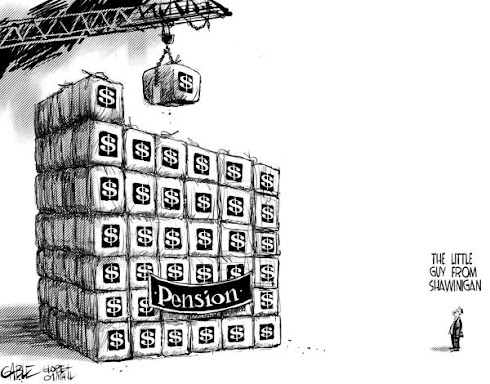

In Alberta the public sector pension plans are billions short. This despite the fact that over the past 30 years taxpayers have funded billions into these plans. Alberta's Public Sector Plans Short Billions

The public sector pension plans pay a replacement income of 70% of final salary for life. There are thousands of public sector retirees earning more than $100K per year in pensions. And they pay much less into their pension plans than self employed taxpayers pay into the CPP program.

Great idea lets hope we can make it work.

No comments:

Post a Comment