There is a wide commentary on pension reform in Canada.

One report says that the catalyst for the interest in pension is based on the protest by Nortel workers last week in Ottawa. The article called Canada's pension system is in play cited 4,000 protesters in Ottawa to protest the bad deal the Nortel pensioners are getting.

All levels of government responded with comments about the pension system and how to save it. Flaherty tackles pension shortfall As well all of the current pension reform proposals in Canada were revisited in the press. One of the best recaps of the pensions reforms in front of Canadians was put together by Monica Townson. The report makes for an excellent read.

Also last week the Globe and Mail ran a great series called Retirement Lost.

Bitter Victory

When I started this blog there were very few comments about the coming pension crisis in Canada. Many of the early reports I posted were newslinks from around the world. These reports detailed the plight that was about to descend on pensions in Canada. Very few reports were in the Canadian press.

This leaves me pondering where my blog will take me now that pensions are a front page news item every day.

One area that I see as lacking in the Canadian press is a complete understanding of the numbers of pensions.

Although this blog is called Fair Pensions For All, most Canadians will never have a pension. We all will at one point want to retire. The focus of the debate needs to move from pensions to retirement savings. It is too bad there is not a good single word term for retirement savings in the same way there is for pensions.

The Real Numbers

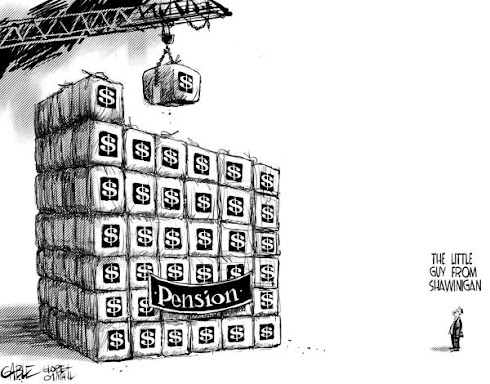

Most Canadian are not part of any pension fund and never will be. In fact only a small portion of Canadian are members of pension plans and very few are members of gold-plated plans.

Joe Meyer was actively posting in the comments section of the Globe and Mail pension series. He has a good understanding of the issues around the subject. What is your professional background Joe?

Joe focused in one of his posts on actual pension numbers in Canada. Statscan produced a series that looked in depth into pensions. Pension coverage in Canada

We know that in October there were 14,091,000 employees in Canada. Of employees in Canada 3,433,000 or 24% work for the government. Most government workers have the gold-plated pensions known as final salary pensions. Statscan shows 82% are covered with mainly final salary plans (defined benefit pensions or DB).

Statscan shows there are a total of 4,538,192 workers covered under DB plans. Of these 1,900,360 are in the private sector. So, 17% of the private sector has DB plans.Most of these would not be gold-plated.

Gold-plated pensions are based on the past 3 or 5 years of working income. Most plans in the private sector have much lower income replacement targets and much longer average earnings periods. For example, a public sector pensions is targeted to replace 70% of final 3 years working salary. In the private sector it may be 50% or 60% of total career earnings.

The other major type of plan in Canada is called a defined contribution plan. These plans cover less than one million Canadians.

So it is disappointing to see all levels of government talking about DB pension issues. These plans cover only a very small portion of the population. Lets expand our focus to Fair Retirement for all Canadians. Most Canadians have no Pension Pot at all.

Thursday, October 29, 2009

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment