In a very surprising move by the Canadian federal government came out with a report from Jack Mintz saying that there is No pension crisis. The Report on Retirement Income Adequacy looked at some of the issues surrounding retirement income security for Canadians. In the report Mintz highlighted that Canadian seniors do not suffer from poverty. Most Canadians retire with a replacement income of close to 90%.

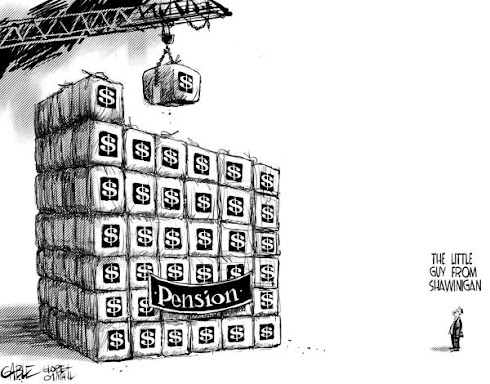

I contend that there is in fact a retirement crisis in Canada. It is based on taxpayers of the baby boomer generation funding platinum pensions for the public sector. The CFIB came out with a release that is calling for restored Fairness for all Canadians on pension inequity

It is unconscionable that Canadian taxpayers are on the hook for public sector pension plans when half of the Canadians working in the private sector will not even benefit from any form of retirement savings.This call came at the same time as the CD Howe released a report that shows how large the liabilities of Canada's public sector pensions really are. The Startling Cost of Federal Government Pensions

Enhanced Public Information

One of the complaints from the CFIB was the lack of disclosure or information about Canada's public sector pensions plans. A side benefit of the Whitehorse conference is that leading up to this meeting more information has become available about the costs of these pensions.

One of my readers, Stephen brought to my attention a Statscan release showing the value of pensions in Canada.$1.8 trillion in pension assets in Canada at the end of 2008.

This $1.8 Trillion is composed of:

- Pension plans - $ 1,064 Billion

- Individual savings plans including RRSP's - $631 Billion

- Social Security including CPP - $140 Billion

The last Statscan workforce survey shows there are 16.873 million working and self-employed Canadians. There are 2.8 million public sector employees in pensions plans in Canada. This means that 17% of Canada's workforce are public sector employees with pension plans. However, they control 33% of the total retirement assets in Canada.

On an average basis each working public sector employee has retirement assets worth $198,464. On the other hand the average Canadian, including those in pension plans have retirement assets worth $81,000. Those not in in pension plans have an average RRSP account of $65,000.

Retirement Income

Statscan reports that there is a big gap in retirement income between those with pension plans and those without.

At the other end of the spectrum are seniors with employer pensions exceeding their combined C/QPP and OAS/GIS. Just one in five 69 year-olds fit this definition, and their average income was more than double that of the other 80%—$43,000 compared with $20,200Of course what this means is that retirement will be an unfulfilled fantasy for many Canadians.

Another strategy for those who have not saved enough for a comfortable retirement is to continue working past age 65. ..Overall, just one in eight 69 year-olds relied on employment or self-employment earnings for at least a fifth of their income, and only one in twenty-five earned enough to account for more than 60% of total income (Table 6). And the income profile of these older workers suggests that many are self-employed professionals who likely do not have substantial employer pensions.The highlight of the report is that:

It appears that over the past 20 years taxpayers without pension plans have contributed an average of $65,000 into their retirement plans. At the same time they have contributed into public sector pension plans so that the average public sector worker has close to $200,000.

The CD Howe shows that taxpayers are on track for another additional $500 Billion of funding into public sector pension plans.

I respectfully disagree with Jack Mintz that there is indeed a pension crisis in Canada. Please listen to the CFIB:

Some additional facts and figures:The inequality issue many Canadians are faced with regarding pensions is a serious disservice to the private sector because it is imposing needless barriers for the private sector to compete on a level playing field with the public sector. This is particularly harmful for small- and medium-size firms, which are the backbone of the Canadian economy.

Pension Satellite Account

Pension Plan Contributions in Canada

Pension Coverage in Canada

No comments:

Post a Comment