Costa Rica is a beautiful country. I was lucky to spend 2 weeks travelling in costa Rica including a stay in the shadows of Arenal an active volcano.

The people in Costa Rica are very friendly and it is a safe country to travel. The minimum wage here is about $300 per month. They pay about the same as North America for most commodities including food, communication and gasoline.

It looks like much is happening leading up to the next federal busdget.

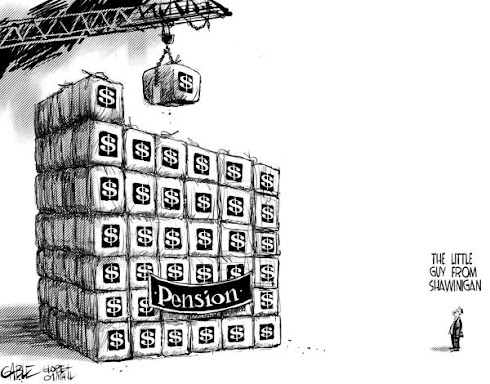

There is lots of speculation about with the budget will bring. Will it contain provisions to control pension costs or will the status quo prevail?

In order to control the costs of public sector pensions, some think that change must start at the top. The Canadain Taxpayers Federation think that MP´s must re-evaluate their own pensions and then look at the public sector as a whole. Class of ´93

MPs indeed have a juicy pension. MP Retiring Allowances Detailed Report .

This is a typical public sector pension plan, I dont know why they call it a retiring allowance?

The tax laws for taxpayers and ordinary non public sector workers only allow for pension accumulation up to about $82,000 per year. Anything over the Federal Tax limit must be set-up in special plans such as RCA´s and SERP´s.

The MPRCA is a special public sector plan.

The purpose of the RCA is to fund a Supplemental Executive Retirement Plan (SERP) for a group of managers or executives on a defined benefit basis. The SERP provides pension benefits that exceed the maximum pension limit prescribed by tax legislation.

These plans are common in the public sector for earners over the pensionable max. Thus Catherine Swift talks about seperate rules for taxpayers and the public sector. Check you local hospital board, school board and municipality many have set-up these specials plans.

Pension boosting and spiking.

This is for the payment of pensionf or income over and above regular income. For example, the plan calls for 3% per year based on the best "sessional indemnity" for 6 years. It appears that MP´s get paid only for for base salary and not all allowances for committees and junior minister positions etc.

This 3% pension compares to the regular public sector that gets 2% per years of service and emergency services who get 2.5%.

The pensions accumulate like this:

3% for 25 years = 75% of annual salary

2.5% for 30 years = 75%2.0% for 35 years = 70%.

Funding

These guys get abut $5 for every one that they put in. See the Members Contribtuions and Government contributions Table 2 contribution schedule.

Future shortfalls of course are all government (read TAXPAYER) backstopped.

Double Dipping

One good note is the double dipping feature if the MP returns to work with the Feds his allowance is suspended. Not a usual feature in public sector plans.

It will be interesting to watch the events leading up to the next federal budget.

No comments:

Post a Comment