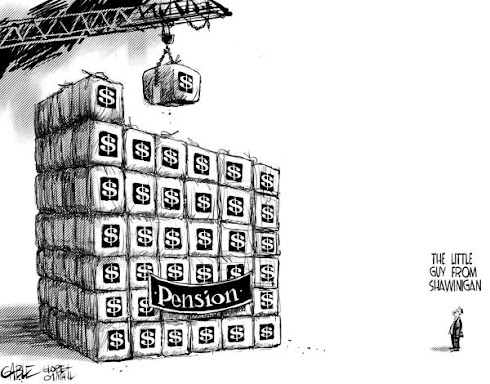

UK Pensions - Same trend as Canada

Well the budget has come and gone and Ottawa has made some very vague comments about pensions. Probably we will have to wait until after more MP's qualify for pensions until Ottawa's MP's take a hard look at the issue. 74 MPs will qualify for pension if election delayed until July 2010

Maybe Ottawa is hoping that the upcoming battle with federal public servants will distract Canadians from the gold-plated pensions of those in the top layer of Canada's two-tier pension system. Public service facing the most cuts

Shifting Pensions

Shifting Pensions is the name of a report from Statscan that shows the trend in pensions in Canada. Shifting pensions - By Philippe Gougeon

The report cites

Registered pension plans comprise defined-benefit (DB), money-purchase or defined-contribution (DC) and hybrid/mixed (H/M) plans. These plans covered 30%, 6% and 1%, respectively, of employees in 2006. Over the last 30 years, a gradual transition away from DB plans has taken place (note: only in the private sector!)When we look at the numbers we see that DB plans cover the largest number of employees they are considered the gold-plated pensions. DB plans are guaranteed, indexed and provide for survivor benefits. Of course these pensions back-stopped by taxpayers are the type our elected officials give themselves and the public sector. The other type of pensions plan DC plans, that a few Canadians have, are much less secure.

Two Tier Pensions

If we analyze the numbers we see that 30% of Canadians have DB plans. The public sector comprises almost 24% of Canada's employees. Of these about 80% have DB pensions. Labour Force Survey.This means he gold-plated plans are predominantly the domain of the public sector. A few large corporations have these plans, many are "Crown corporations" of the balance sheet of the government but fully backed by taxpayers.

To restate the numbers; 20% of total Canadian workers are covered in government DB plans and only

24 % of the remaining Canadian workers have pensions.

Of course Canada has no pension problem. We would have to have pensions for there to be a problem. With over 76 % of private sector employees having no pensions there is no problem.

No comments:

Post a Comment