A recent article on Bild.com outlined the anger that Germans felt towards bailing out Greece.

Greece has an economy that is melting down because of the inability of the government to control public spending. German anger at paying for luxury Greek pensions.

Europe - Germany vs Greece

One of the more interesting point in the article is the disparity between the pension system in Germany and the one in Greece.

That means that with a broke Athens seeking outside help, Germany and the rest of the EU aid givers must start pouring cash into the bottomless Greek pension pit...

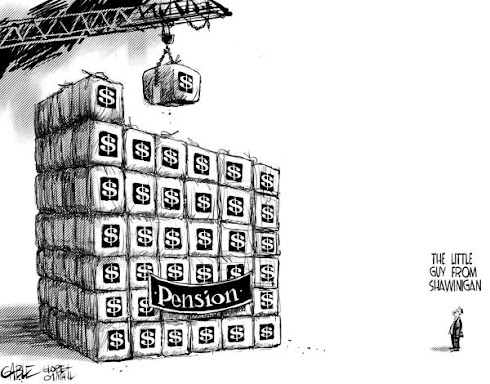

Canada - Public Sector vs Private Sector

In Canada we can make the same analysis with retirement. The private sector would have a system similar to Germany and the public sector has a plan similar to Greece

Canadian taxpayers must start pouring cash into the bottomless public sector pension pit...

Public | Private | |

Earliest years of work to earn full pension: | 30 | Non-existant |

Proportion of wages as pension: pension vs CPP | 70 % | 25 % |

Contributions required for employees based on Salary* : | 8.5% | 9.9 % |

Total accumulation in pension plans ** | $805 B | $ 314 B |

Pension increase 2010: | 3 % | 0.4 % |

Average Ontario Teachers Pension vs. CPP | $40,000 | $11,210 |

Average retirement age vs. self-employed | 59 | 65 |

Percentage covered by gold-plated pensions | 80% | 18% |

Minimum pension age: | 50 | 60 |

* contributions based on current federal government contributions required and CPP required for self-employed. http://www.tpsgc-pwgsc.gc.ca/remuneration-compensation/apr-sam/apr-sam-2-5-1-eng.html ** Statscan report: Pension assets by type of plan at market value 2007 http://www.statcan.gc.ca/pub/13-605-x/2008002/t/5213171-eng.htm | ||