Tuesday, May 11, 2010

The best way to rob a bank is to own one!

Check out this excellent video from PBS

http://www.pbs.org/moyers/journal/04032009/watch.html

.

Sunday, May 9, 2010

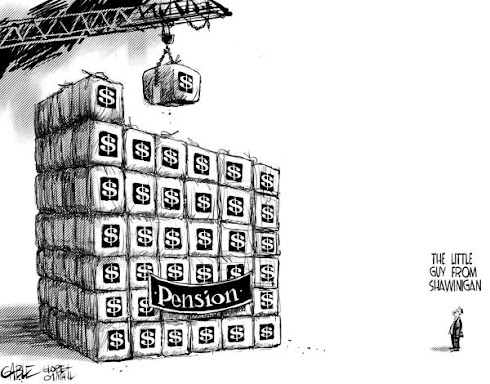

Pension Apartheid

There was a recent election in the UK. One of the key election issues has been Pension Apartheid.

The Daily Mail in the UK reported that Pension Apartheid is:

The huge bill taxpayers face to pay for the pensions of the country's 5.8 million public sector workers. ...This means that public sector workers can retire relatively young on generous sums whereas private sector workers have to retire later and get less money.Canada is suffering Pension Apartheid as well.

Unfortunately in Canada no one has been able to put together the annual cost of public sector pensions. It must be staggering as cities, provinces, universities, hospitals and school boards all funnel tax dollars into the pension plans of public sector employees.

Statscan Pension Satellite Account

In a report from Statscan in 2007, the size of Canada's Pension Apartheid was reported. Canada's Pension Apartheid

This is one of the graphs from this report. We can see that Canadians have funded billions of dollars into public sector plans at the expense of their own defined contribution plans or RRSP's. In fact, two of the bars in the chart show the public sector plans.

The bar called Government Consolidated Revenue Arrangements is the pensions for high income earning public sector employees. Like the one recently uncovered for the retiring 47 year old Police Chief of Montreal. He is entitled to a $135,000 a year pension, a pension with a cash value of around $2.2 million.

The Government Consolidated Revenue Arrangements are a form of taxpayer abuse. They have special rules which the public sector have created for taxpayer funded pensions, for themselves. Read the note on the table

These supplementary employee retirement plans were set up to provide pension benefits to (public sector) senior employees beyond the maximum permitted registered pension plan benefits as set out in the Income Tax Act.Total Contributions

The total value of pension assets in Canada, are covered in a confusing table produced by Statscan. Pension assets by type.

There are about 3.6 million public sector employees. With $805 Billion public sector workers have an average of around $230,000. In the private sector there are about 13 million workers. They had a total of $1 Trillion in pensions and RRSP's. This means an average of $80,000 in retirement savings for private sector workers.

For every 1 dollars that taxpayers have been able to save in their retirement pots they have funded the accumulation of 3 into public sector pensions. Several reports over the past month have shown us that many hundreds of billions more are required to bring public sector pensions up to full funding.

Who is going to take the initiative to end this Pension Apartheid?

Friday, May 7, 2010

Pension reform coming together

Recently Johnathan Chevreau covered a report issued by one of Canada's self-regulatory financial organizations, IFIC. $ 1.7 Billion reasons

It is interesting to see how pension reform is all coming together.

The investment industry in Canada has been fighting the claim that the MER's they charge are too high. We know the impact of the these MER's on the long term value of retirement plans.

The gap between the haves and the have not's is too big in Canada to ignore. The gap between the gold-plated public sector pensions and private sector taxpayers.

These principles are directing Canada towards some sort of pension changes.

The insurance industry and banks are fighting to keep control of the investment industry in Canada. It is their business and their bread and butter.

We have seen the implementation of the additional mandatory level of pensions in the UK. The Canadian insurance industry is touting a model based on the Kiwi Saver. It is know as a "soft" mandatory pension.

http://www.kiwisaver.govt.nz/

A Canuck Saver would be a similar program. It would have mandatory enrollment with an opt out option. At the base level the employer, government and employee each put in a one-third contribution. Best of all the insurance industry and banks still manage the funds.

The Canadian insurance industry needs a model whereby they will continue to manage the funds. They are proposing to do it for under 100 BPS or 1%. This is a long way from the 2.5% they charge in MER's now. This means the advisors will be cut out of the commissions they receive today. Advisors will be forced to go to a fee for service model.

The model for additional retirement savings is based on a CPP type plan. Where the retirement income is Defined Benefit.The current level of coverage with the CPP is 25% replacement income up to the YMPE limits. The current discussions call for increasing the YMPE limit from around $47,000 to $100,000. Also an increase of replacement income up to 50% is being debated.

It will be hard to see how Canadian savers will find extra money for either of these options. For example, as a self-employed individual I contribute 9.9% of my income into the CPP. Both these options would double my contributions.

The government could give any increases to mandatory retirement savings to a large pension plan (OMERS, OTPP or the CPP) to manage but this would mean cutting out the current financial industry services. Of course IFIC wants to defend their turf. As well they should!

Politicians are aware that the financial services industry is the largest driver of GDP in the country. To upset the apple cart too much would be very dangerous. When looking at the country's GDP we see that Canada has a GDP of $1.2 Trillion.

Statscan GDP Table -www.statcan.gc.ca/.../t100430a1-eng.htm

Total GDP $ 1.2 Trillion - (based on this report, there are different ways of calculating GDP)

Financial Services - $ 256 Billion

Gov't (Public admin, Education, Health Care) - $ 217 Billion

Manufacturing - $158 Billion (down from $180B 2 years ago)

Oil, gas and mining - $51 Billion

Financial services and government administration have been the only two sectors growing over the past 2 years during the Great Recession. Financial services are essential to the future growth of our economy.

The public sector pension gap needs to be eliminated.

It is ridiculous to think that the average $157,000 that high income Canadians have in non-registered funds is adequate. If the $100,000 earner wanted a replacement income of 70% it would be gone in two years.

On the other hand a public sector employee earning $100,000 is guaranteed 70% replacement income on his gold-plated pension, when fully qualified. This would means $60,000 per year coming from a public sector pension. CPP ($11,200) picks up the other 10%.

A private sector employee in order to generate a $60,000 a year pension would need a retirement pot of $960,000.

Canadians have diverted hundreds of billions of dollars into public sector plans. Statscan showed about $ 800 Billion in 2007. www.statcan.gc.ca/.../5213171-eng.htm

Lets put all Canadians public sector and private sector on the same retirement income level. A replacement income of 50% would be a good compromise between the 25% CPP pays and the 70% gold-plated plans public sector pension. Diverting some of the tens of billions Canadians currently fund into public sector plans would help provide a better retirement for all Canadians.

Keep watching!

Subscribe to:

Posts (Atom)