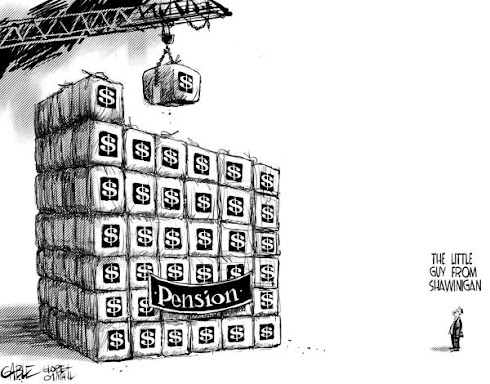

We have seen the problems that Legacy Costs have created in our society. They have the potential to divide society between the haves and the have-nots.

A system where a few have a lot and the majority have - or will have - very little indeed....The difference-maker in our futures, says Bill Tufts, is going to be our pension plans. Public or private. Gold-plated pensions versus pensions that might not even hold a coat of yellow paint. ROY MacGREGOR - Globe and Mail.Hole to Fill

One interesting situation is occurring in England where two companies begun giving the assets of the company to employees. They have given the assets to their employees to fund pension plan liabilities. Pension plan holes to fill.

These are assets that did belong to the shareholders of the companies but are now being diverted in what Peter Drucker called the "Pension Fund Revolution". It is a form of socialism whereby pension funds control and own most of societies assets and equities. Drucker predicted that by 1985 pension funds would own, in America half of the equity capital on American corporations.

I have covered pension socialism in some of my blogs.

Government's Biggest Expense

The biggest expense of any government organization is the compensation costs of the public sector employees. It is the commitment made to these employees after they retire that are know as legacy costs.

Many government organization are top heavy with older baby boomers at the cusp of retirement. Having made gold-plated commitments to these employees, many organization are finding themselves short. This will put huge pressure on increased revenues for these organizations.

Revenues to a government employee, taxes to us.

Ontario's Power Trip: The 20% Hydro Grab

The National Post has been running an excellent series on Hydro electricity in Ontario, The author of the series is Parker Gallant. He recently reported on the anticipated 20% increase in hydro costs in Ontario.

In past articles on Hydro Ontario, Parker pointed out the huge cost of employees at Ontario's Hydro organizations.

These organizations have huge legacy costs. Part of the reason is the high compensation paid to employees. Parker covered some of the issues surrounding the compensation at the hydro monopolies. Ontario's power trip: Priced out of the market

Now we see hydro rates in Ontario will be rising by 20%.

Legacy costs

The hydro business in Ontario, all government owned have thousands of employees who are earning in excess of $100,000 per year. Of course most will be entitled to a gold-plated pension as well. On valued at 70% of their earnings. This means at retirement each employee needs in the pension pot close to $1 Million.

It is impossible to fund all of these obligations there fore the taxpayers have pension and future benefits liabilities in these electric monopolies.

OPG, Ontario Power Generation has accumulated $8 Billion into it pension plan for retiring workers. Last year the employees contributed 23% of required pension contributions or $75 million into the pension plan compared to taxpayer's contribution of $ 254 million.

Currently there is a liability for future employee benefits of $1.5 Billion. If the plan were to wind-up tomorrow or convert to a defined benefit plan there is a $2.8 Billion liability.

OPG Financial Statement - See note 12 for pension and benefit liability details.

For taxpayers the OPG returned a profit of $ 88 million.

It has become apparent that the number one concern of a generation of soon to be retired baby boomers is the commitment taxpayers have made to their legacy costs. The focus of these government operation now is not how to make our society better, or how to make our economy more competitive. It is how can we get more revenue to make sure that the gold-plated legacy costs of the public sector is covered.

Bill Tufts

Fair Pensions For All