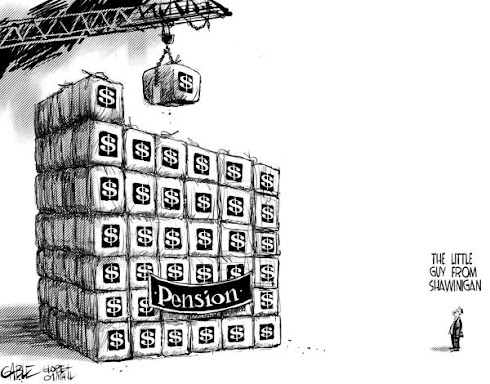

It is a party that taxpayer fund but never attend!

N.B. pension funds bounce back

New Brunswick's 49,000 teachers, judges and civil servants can breathe a sigh of relief because their pension fund is back in the black.These plans combined are almost a billion dollars short. The shortfall exists despite heavy duty contributions by taxpayers into the plan.

But that doesn't mean the Liberal government's $749-million deficit will be any smaller this year.

That's a major improvement from 2008-09, when the pension funds lost $1.7 billion, or just over 18 per cent, in the global stock market meltdown.Sinclair said the annualized four-year return for the three funds is 1.77 per cent and since the inception of the New Brunswick Investment Management Corp. in 1996, the return is 6.5 per cent.

"Most importantly our annualized real return (after adjusting for inflation) since inception is 4.46 per cent, exceeding the target of four per cent set by the actuary," he said in a media release.

"These returns have been achieved in spite of the adverse effects of the prior year's global financial crisis."

Sinclair said unlike some pension funds, the corporation wasn't forced to sell holdings during the downturn to meet obligations to pensioners.

The corporation's net assets under management as of March 31 were $8.341 billion, up from $7.029 billion as of March 31, 2009.

The increase in net assets under management resulted from $1.384 billion in net investment valuation gains, plus $150 million in special funding payments from the province, less net pension payouts of $223 million.

The overall gross rate of return for the three funds was 19.94 per cent.

Last year the employees in the pension plans contributed $111 Million and the taxpayers contributed $269 Million. The plan is still $ 750 Million short. Page 39 of a horrible report!

The contributions work out so that the employees pays just a small portion of the total retirement funds required. Taxpayers pick up the rest!

The contributions for the general public service is 32.5 cents on the dollar for teachers it is 25 cents and for judges just 16 cents of every dollar required. CFIB calls for at least a 50% contribution

Already taxpayers have contributed the largest portion into these pension plans. The plans have $8.3 Billion in them for 49,000 workers. This works out to an average of $170,000 per worker.

At the same time in New Brunswick taxpayers have an average of less than $ 40,000 in retirement vehicles.

It looks like taxpayers in New Brunswick are getting the shaft!

Bill Tufts

http://fairpensionsforall.blogspot.com/

No comments:

Post a Comment