It is reported in Big pension plan pressed to fix funding woes that:

Canada’s biggest private sector, multi-employer pension plan hasn’t fixed mounting underfunding problems or clearly informed members about possible reductions in benefits.

The Financial Services Commission of Ontario will not comment publicly about persistent troubles with the Canadian Commercial Workers Industry Pension Plan (CCWIPP).

The commission’s letter charged that the plan has not told more than 300,000 members that their pension benefits are “seriously underfunded” or what they would get if the plan had to be wound up.

Canada’s biggest private sector, multi-employer pension plan hasn’t fixed mounting underfunding problems or clearly informed members about possible reductions in benefits, government watchdogs reveal in internal correspondence.

All defined benefit pensions in Canada are under serious strain. What makes them painful is if they are in the private sector or the public sector.

Canada's Largest Public Sector Pension

Statistics

- 175,000 teachers in elementary and secondary schools in Ontario

- 114,000 pensioners – includes survivor pensions

- Plan originally created in 1917

- One of Canada’s largest payrolls, paying $4.4 billion in pension benefits annually

Financial

- Net assets: $96.4 billion (December 31, 2009)

Benefit Design

- Defined benefit plan: 2% x years of credit x average “best-five” salaries = annual pension

- Targeted replacement income of 70% of final 5 years. Highest retiring salary of teachers $ 102,000

- Unreduced retirement with 85 factor (age plus qualifying years = 85)

- Partial years count as full years for determining the 85 factor,

- Members can repay refunds and buy back service for leaves

- Indexed up to 8% per year

- Indexation is 100% of CPI

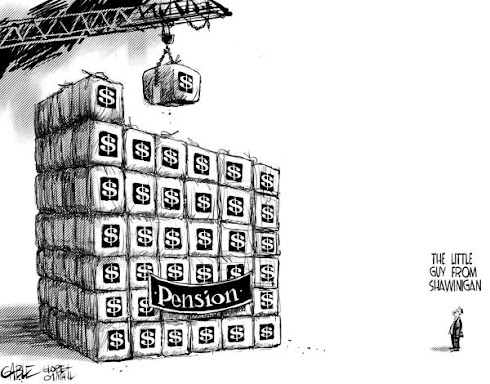

A quick look at these two pension plans shows the hoodwinking that has been put on Canadian taxpayers. Last year Canadian taxpayers funded about $30 Billion into public sector pension plans.

You get a lot of pension for that sort of money.

Comparison Chart

Private Sector Ontario Teachers

CCWIPP OTPP

Assets $ 1.68 Billion $ 96.4 Billion

Workers 350,000 175,000

Retirees 20,000 114,000

Total Members 370,000 289,000

Avg Assets $ 4,500 $332,000

Avg Assets $ 4,500 $332,000

Avg retiree pension $ 6,450 $ 38,596

Employer contribution $139 Million $ 2.72 Billion (taxpayer)

Normal retirement Age 65 Age 55

Pension shortfall $ 760 Million $ 17 Billion

Special taxpayer

Contributions 2010 $ 000 $ 500 Million

Notes: CCWIPP Annual report

Ontario Teachers' Plan projects $17B shortfall

Horrible deal for Ontario teachers - $102,000 per year

Horrible deal for Ontario teachers - $102,000 per year

Pension Envy

This example shows why most taxpayers in North America are suffering from pension envy. Jonathan Chevreau covers the issue of pension envy in his article Don't count on Ottawa to fund your retirement.

This example shows why most taxpayers in North America are suffering from pension envy. Jonathan Chevreau covers the issue of pension envy in his article Don't count on Ottawa to fund your retirement.

Bill Tufts

Fair Pensions For All

No comments:

Post a Comment