Pension limits for public sector pensions

No information is available regarding the amounts paid to current retirees in public sector. For example how many earn more than $200,000 in pensions, how many are over $150,000 and how many are over $100,000?

Many states require this disclosure as part of the Sunshine Laws that many jurisdictions have enacted. Ontario has one for the salaries of public employees but not for pensions. This needs to be changed.

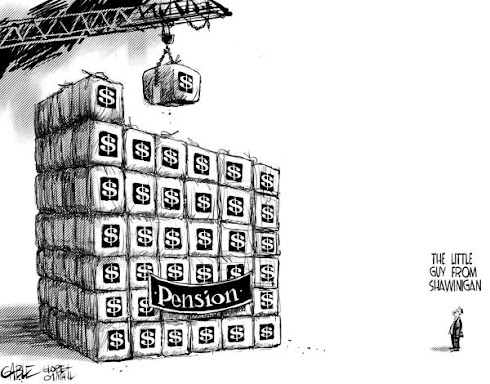

There are thousands of public sector employees earning pensions in excess of $100,000 per year at all levels of Canadian government. Most employees in government earning over $140,000 per year will get a pension in excess of $100,000. That is a fixed income for life never to work again.

Some jurisdictions in North America have put limits on pensions of $100,000 per year. This would be generated from a final retiring income income of about $142,000 a year. ie. 70% of $140,000. One idea is to base to pension limit on a factor of the Canadian average wage. The average wage for working Canadians is a little over $42,000. Set the pension limit at two times this amount and say that a public sector pension limit of $84,000 is fair.

A supplemental pension is available to big earning public sector employees. These supplementary employee retirement plans were "set up to provide pension benefits to senior employees beyond the maximum permitted registered pension plan benefits as set out in the Income Tax Act." So that once public sector employees went over the pension and earning limits set out for taxpayers they created these special pensions for themselves.

The supplemental pension limit is around $132,000. Any pensions paid over of this limit are paid into a supplemental pension plan designed to fund the excess amounts. The limit has been raised substantially in the past few years.

While the average Canadian is earning an income of just over $42,000 for working. The PSP federal pension plan shows that the average employee retiring this year starts on a pension over $39,000 most at age 55, for never working again.

We have to consider the opportunity cost to our society for setting adrift large numbers of public sector employees into retirements at early ages. Most public sector pensions have indexing that will see them will surpass the average working wage within just a few years.

The most popular blog here has been Tales from the other side of the aging catastrophe.

It explains and has examples of what will happen when our society has more retirees than workers.

Bill Tufts

Fair Pensions For All

No comments:

Post a Comment