What are fair income replacement levels?

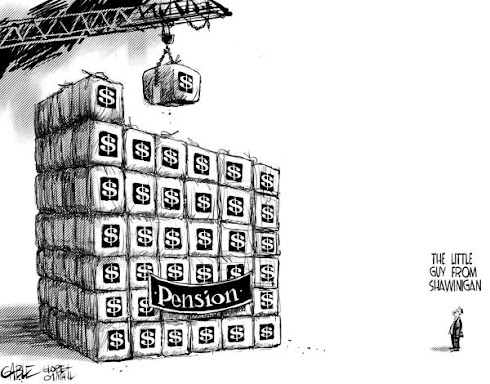

Why do we pay 70% replacement pensions for public sector employees? Many will retire with a higher standard of living and with more disposable income than they had while working.

Other sources of personal income are not taken into account. What is a fair replacement level?

Public sector pensions are designed to provide 70% of final year's income. By contrast the CPP is designed to provide 25% replacement income.

Most Canadian retirees see substantial drops in the cost of living at retirement. The most significant factor is that in Canada about 85% of Canadian over age 65 have no mortgage. On the other hand for most working Canadians about 28% of salary goes into paying a home mortgage.

At retirement there are reductions in payroll taxes. For example, the CPP pension or EI contributions are no longer required. The CPP is a payroll tax of 4.95%. Also the pensions contributions that public sector employees make, around 10% of income are no longer required.

Many public sector employees will retire with more disposable income and a better lifestyle than they had when they were working. Is it fair to pay public sector employees a taxpayer funded pension that provide a replacement income of 70?

I recently covered this issue more fully in How Much is Enough?

Bill Tufts

Fair Pensions For All

No comments:

Post a Comment