There was an article today in the Globe and Mail that shows that Canadians are still in deep trouble on household debt

Net worth continues to climb

Wealth in Canada continues to rebound from the great crash.

Overall household net worth increased 2.2 per in the fourth quarter to $6.2-trillion, following on the third quarter's 3-per-cent climb, Statistics Canada said today.

On a per capita basis, that's an increase to $181,700 from $178,200.

"The gain in the Standard and Poor's/Toronto Stock Exchange composite index of about 9 per cent in the fourth quarter was reflected in rising values of household equities (including mutual funds) and pension assets, albeit at a slower pace than the previous quarter," the statistics gathering agency said.

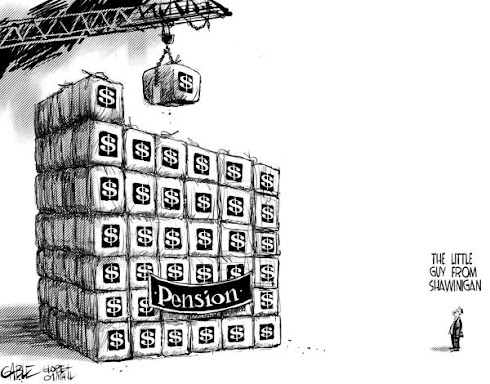

This is good news for those Canadian who has some savings and pensions but for the great unwashed masses this really means nothing.

The last Statscan report on Inequality in wealth shows some pretty grim statistics. Although the numbers were from 2005 not too many Canadians who has seen much of an increase in their personal wealth. The trend is the wealthy continue to get wealthier and the rest... well not as well.

Between 1999 and 2005, the median net worth of families in the top fifth of the wealth distribution increased by 19%, while the net worth of their counterparts in the bottom fifth remained virtually unchanged.

As a result, the top 20% of families held 75% of total household wealth in 2005, compared to 73% in 1999 and 69% in 1984.

Part of the growth in net worth among families in the top 20% of the distribution was fuelled by increases in the value of housing.

- In both 1999 and 2005, the vast majority of these families (at least 95%) owned a house. During the six-year period, the median value of their principal residence rose a solid $75,000, reflecting sharp increases in housing prices.

- In contrast, the value of holdings on a principal residence changed little among families in the bottom 20%. At most, 6% of these families owned a house during this time.

Here is a chart from Statscan chowing that the top 10% of Canadians control almost 60% of the total wealth of the country. I am afraid that this will part of the reason for social unrest in North America.

Maybe this is what Michael Moore was ranting about in this video from the Wisconsin protests. Michael Moore says 400 Americans have more wealth Please listen to Part 2 of the video as well, it comes on automatically.

Here he is interviewed in a very interesting video on The Rachel Maddow Show. Last Saturday there were in excess of 100,000 protesters in attendance at the Capital Hill in Wisconsin

As we do research for our upcoming book there are more and more instances of commentators suggesting a complete meltdown of our economy. One similar to what has happened in Japan. But the chances are we will not be able to borrow to the extent of 200% of GDP that Japan has. Japan has borrowed this money to sustain their standard of living.

The Japanese stock market is down 75% since it's highs in 1989Courtesy Seekingalpha.comHang the rich: Great war inevitable, pundit predicts

Richard Worzel - Revolting Civil Servants

Stephen Gray -Are we seeing political treason?

Bill Tufts

Fair Pensions For All

No comments:

Post a Comment