Bill Gates: How state budgets are breaking US schools

The Coming Social Security Crisis - Who will pay?

Wis. Gov. Discusses Curbs on Union Benefits

San Diego Mayor on city's pension crisis. Thanks to CFFR

Public Pension Problems: a Tale of Two Cities in Rhode Island

RI - A small state with big pension problems

Fire Hero Gets Schooled

Retirement System of Alabama in Crisis

Utah Governor on New Pension Plan (Click Here)

CBS 60 Minutes State Budgets Day of Reckoning Pension Crisis

Unions Gone Mad

CALPERS Aristocracy

Catherine Swift talks about pensions on behalf of Canadian small business owners.

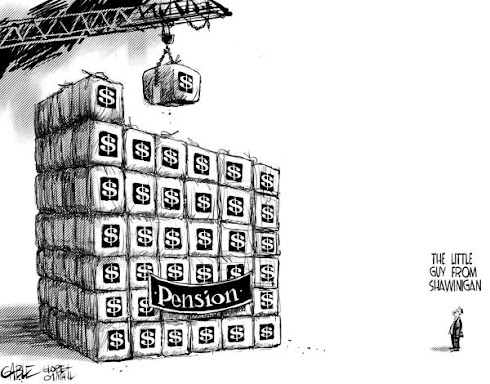

Pension Tsunami's Jack Dean on the Growing Wave of Public Pension Debt

Managing the Crisis in Public Pensions

States have promised public workers a secure retirement, but recent events and new studies have shined light on an acute crisis. Public pensions are radically underfunded and fundamental reform is no longer an option but a necessity. State policy makers can no longer avoid addressing this shortfall with many public employees approaching retirement. The future fiscal stability of states is inextricably intertwined with the retirement security of public employees. This panel addresses what steps policy makers must consider, and what pitfalls to avoid on the road to reform.

Public-Pension Deficits: How Big? Can They Ever Be Paid?

American Enterprise Institute

Pensions for public-sector employees are consuming such escalating shares of state and local budgets that governments are faced with the choice between paying for current police, teachers, and firefighters and paying benefits to retired employees. It could be much worse. Economists increasingly challenge the accounting used by public-sector pensions, arguing that it hides trillions of dollars in unfunded liabilities that put budgets and taxpayers at serious risk. Taxpayer risk may be exacerbated as pension funds move their investments into more exotic instruments, such as foreign stocks, hedge funds, and private equity, to try for higher returns. So, how big is the public-pension deficit? As the Governmental Accounting Standards Board reviews public-pension accounting, what should it focus on? What are the possible consequences of these changes? At this event, a panel of retirement experts and public policy economists will address the growing threats to the pension liabilities of states and municipalities.